August 14, 2025

According to the Helsinki Times, Finland’s UPM, Neste, and St1 are jointly advancing plans to produce sustainable aviation fuel (SAF) from wood residues.…

August 12, 2025

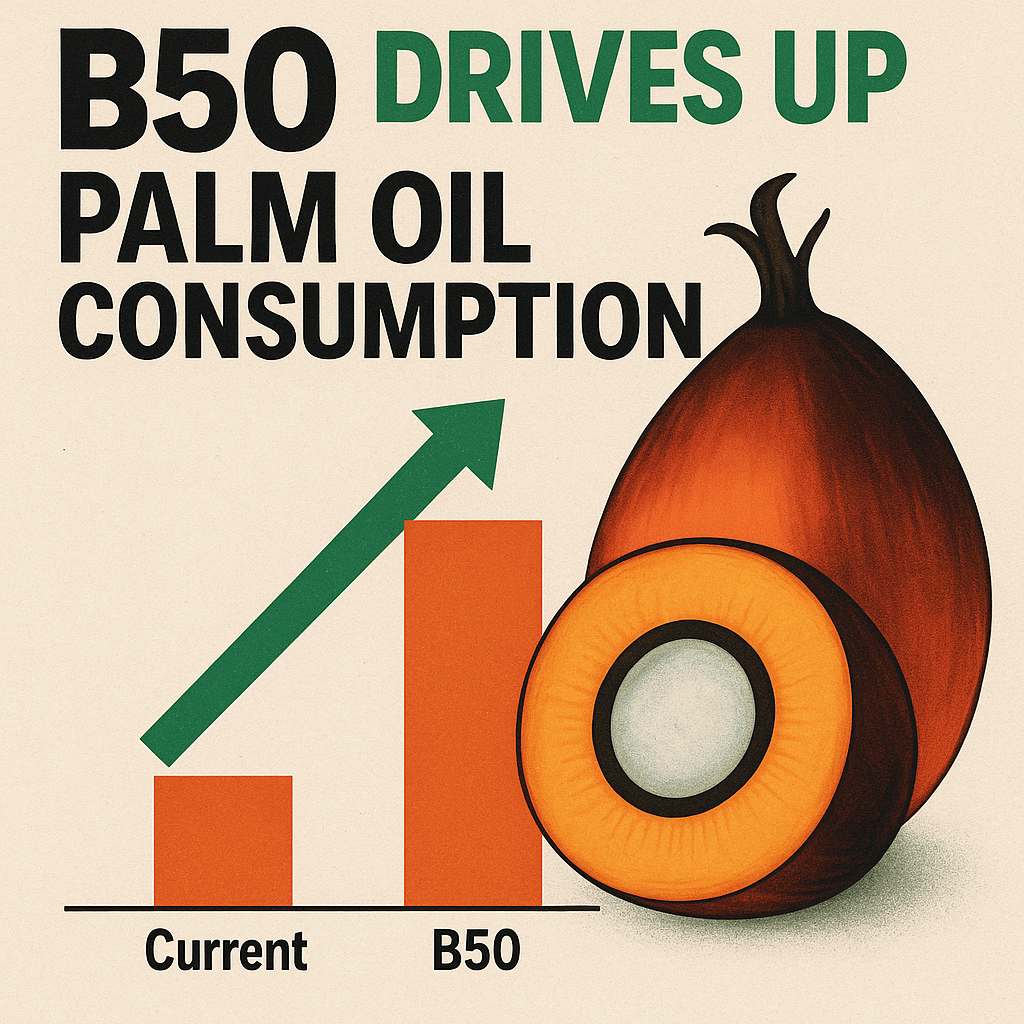

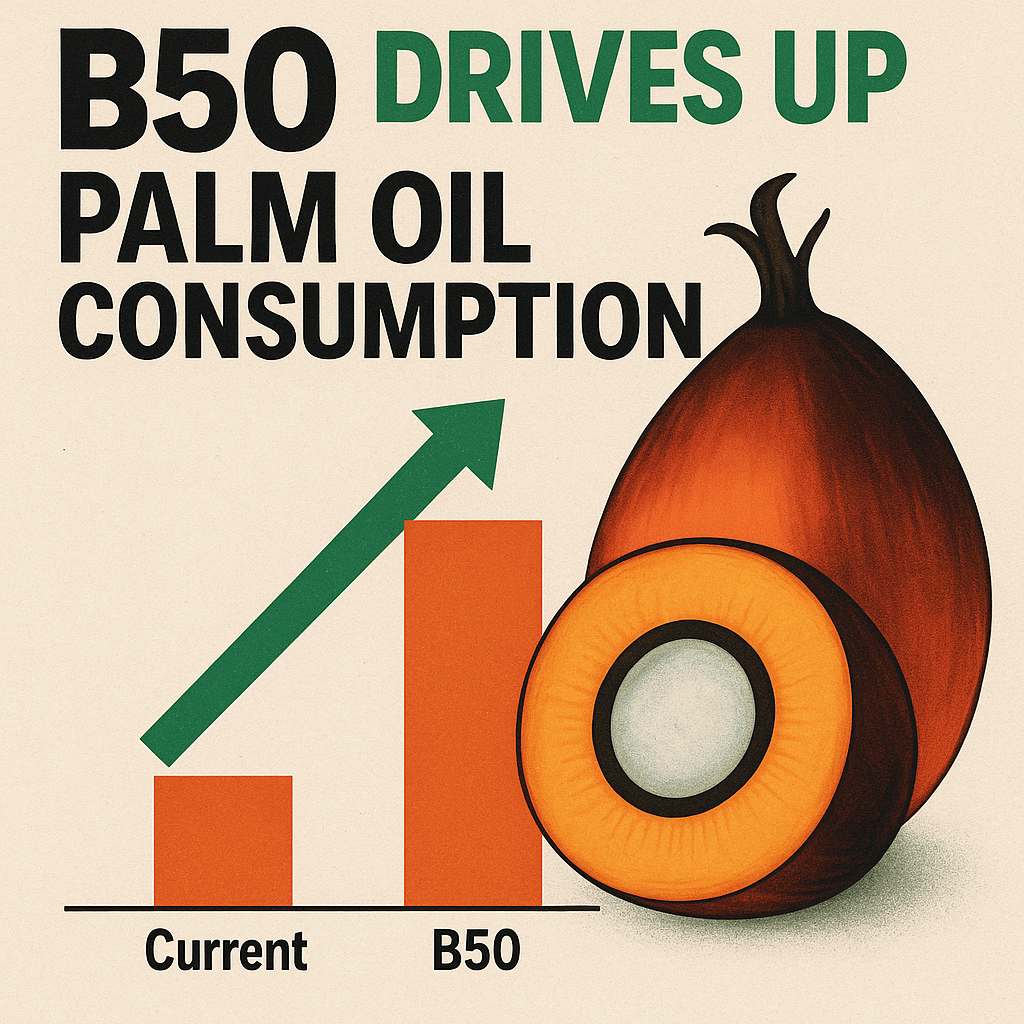

Indonesia will proceed with its plan to raise the palm oil content in biodiesel to 50% (B50), but the rollout is unlikely…

August 7, 2025

As the European Union accelerates its renewable energy transition, EcoCeres has released a position paper calling for a robust, transparent, and fraud-resistant…

August 6, 2025

On August 1, renewable fuel producer EcoCeres Inc. announced a partnership with Xiamen Airlines to jointly promote the localized collection and production…

August 5, 2025

According to the Bangkok Post, Thailand’s Department of Energy Business recently announced that the country plans to officially release its first national…

August 2, 2025

Recently, Laos officially launched a pilot project to produce biodiesel from waste cooking oil, aiming to foster innovative energy technologies and sustainable…

August 2, 2025

XCF Global has unveiled a strategic plan to invest nearly $1 billion (€860 million) over the next three years to build a…

July 31, 2025

On July 28, the European Commission approved a €36 million ($41.07 million) Danish state aid scheme aimed at promoting the use of…

July 30, 2025

According to Reuters, Indian Oil Corp (IOC), the country’s largest refiner, plans to upgrade a diesel desulfurization unit at its Panipat refinery…

July 30, 2025

CIMB Securities, a leading investment bank in Indonesia, recently published a study suggesting that if the Indonesian government implements the B50 biodiesel…