August 7, 2025

As the European Union accelerates its renewable energy transition, EcoCeres has released a position paper calling for a robust, transparent, and fraud-resistant verification system…

August 2, 2025

Recently, Laos officially launched a pilot project to produce biodiesel from waste cooking oil, aiming to foster innovative energy technologies and sustainable business models.…

July 30, 2025

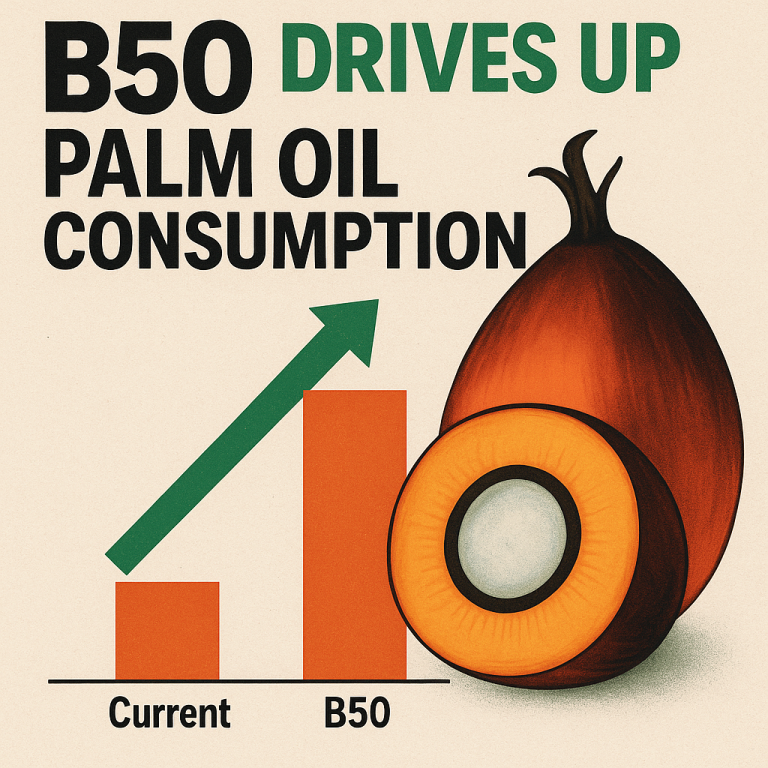

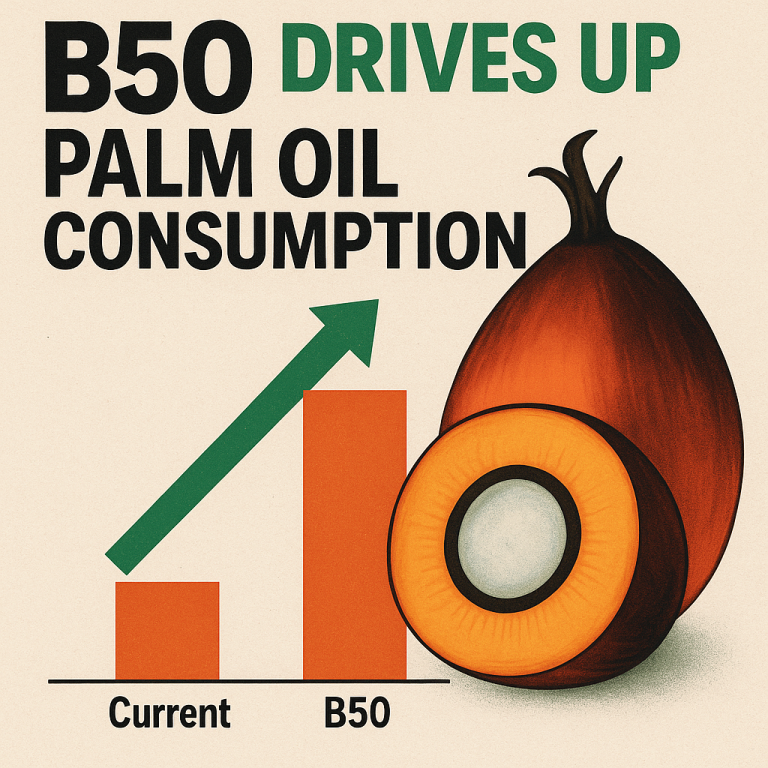

CIMB Securities, a leading investment bank in Indonesia, recently published a study suggesting that if the Indonesian government implements the B50 biodiesel mandate, domestic…

July 21, 2025

On July 18, the European Commission announced the conclusion of its investigation into Chinese biodiesel imports, stating that no fraudulent behavior was identified. However,…

July 18, 2025

SD Guthrie has launched a B30 biodiesel pilot project in collaboration with Malaysia’s Ministry of Plantation and Commodities (KPK), Petronas Dagangan Berhad (PETDAG), and…

July 10, 2025

On July 10, Greenergy, a UK fuel company owned by global commodities trader Trafigura, announced plans to close its biodiesel plant in Immingham, northeast…

July 8, 2025

Zhuoyue New Energy announced on the evening of July 8 that it plans to invest RMB 700 million of self-raised funds in a bioenergy…

July 5, 2025

The U.S. Clean Fuels Coalition recently expressed strong support for the improvements to the Section 45Z clean fuel production tax credit included in the…

June 21, 2025

The Trump administration has recently unveiled a significant proposal aimed at substantially increasing the proportion of renewable fuels blended into the U.S. fuel supply…

June 15, 2025

According to BNamericas, Argentina has introduced new regulations regarding the use of biofuels in maritime transport. Under a reform announced by the Federal Energy…